Getting your money right with SoFi

How to use SoFi's platform to manage your entire financial picture.

I recently wrote about SoFi from an investor perspective going in depth on the company’s financials and future prospects. One of the reasons I invest in SoFi though is because I love and use their products, so I wanted to switch it up and dive into SoFi from a consumer perspective, and how you can use the application to get your money right.

First I want to establish why this is important:

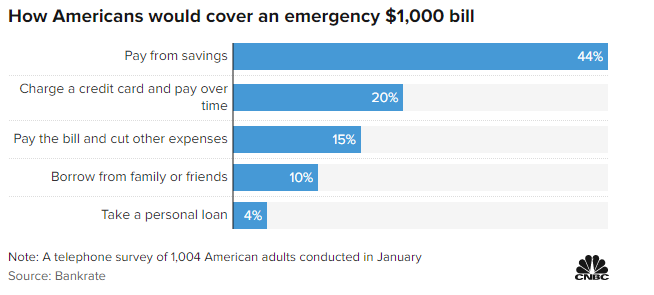

56% of people can’t afford a $1000 emergency bill. This is the top cited money-related issue negatively impacting mental health, with 57 percent of respondents in a Bankrate survey citing it as having a major negative impact on their mental health.

Outside of just emergency funds, the APA reported that 65 percent of respondents said money is a significant source of stress.

Stress is inevitable in life, and it’s impossible to remove entirely, but financial wellness is one area that can be improved to hopefully make stress easier to bear. One less thing to worry about I suppose.

SoFi is the platform I use to manage my financial wellness, so I wanted to share in depth how you too can leverage the app at all stages of your financial journey.

If you’re interested in learning more about the company from an investor perspective, you can read my article about that here:

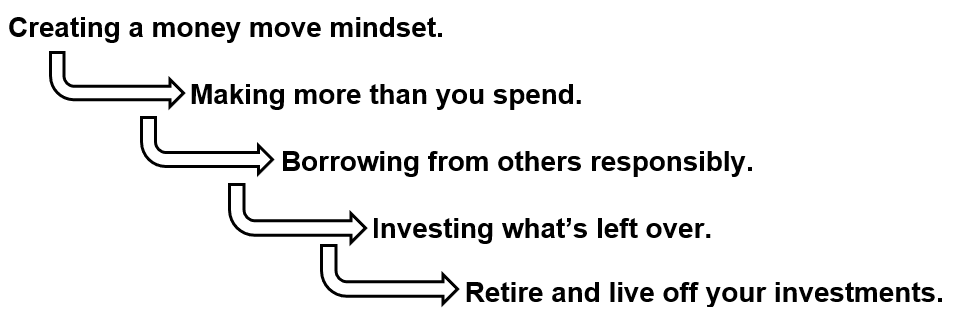

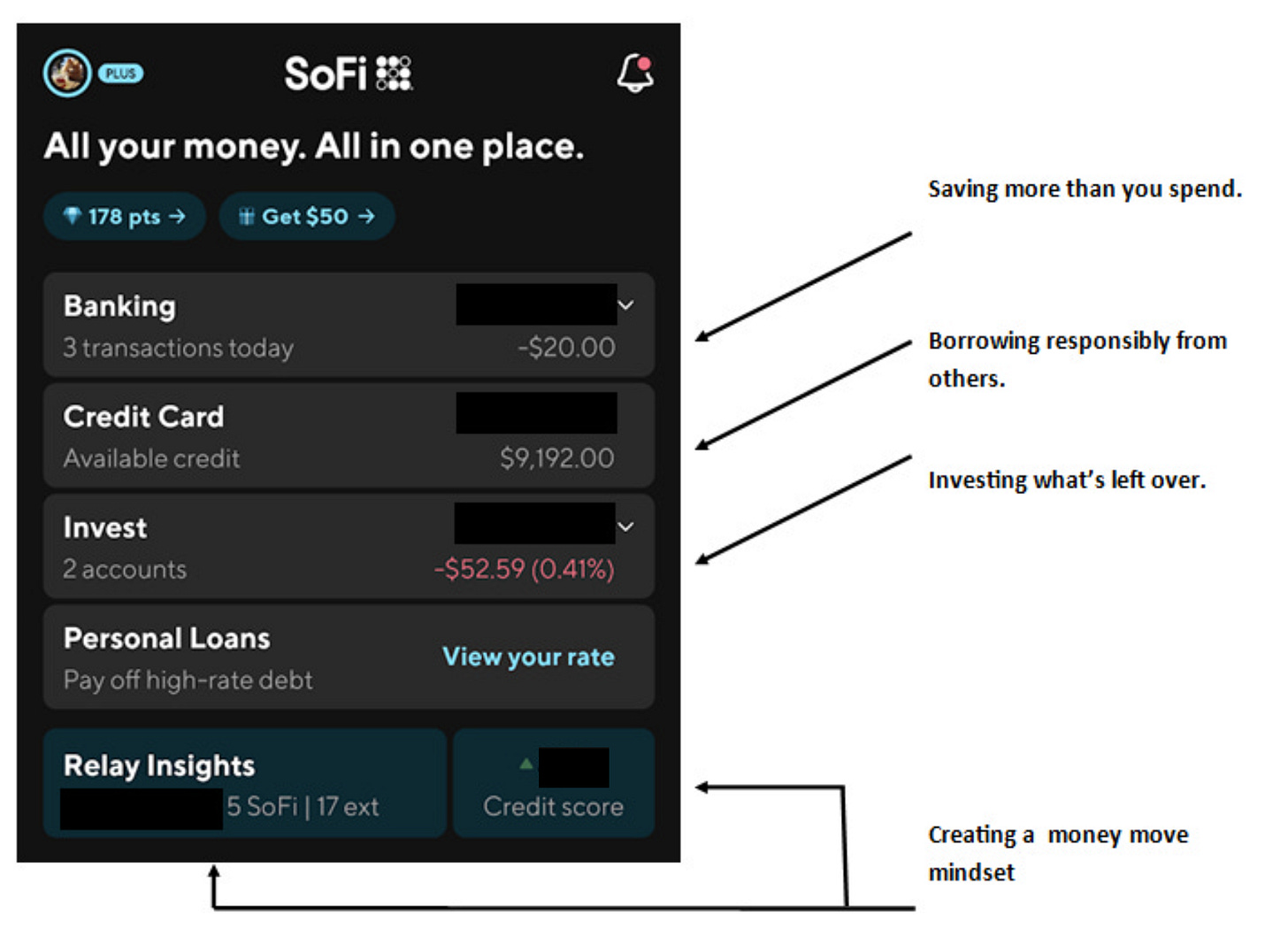

First let’s take a look at the SoFi home screen in its complete state, and then break each section down as we progress through my really oversimplified steps of financial wellness which are:

Some things in this article won’t apply to everyone as every person is in different stages of their financial lives, and each person has unique ways of managing things. That being said, I will attempt to go through these steps as if someone was just starting out from step one.

For now, let’s start with step one: Creating a money move mindset (Get Organized)

If you’re new to SoFi that’s okay. It isn’t required to open up any new bank, credit, or investment accounts to get started.

The first step to a strong financial mindset is to fully understand your financial picture as it exists today. Knowing this will help you clearly evaluate areas that need improvement, allow you to set financial goals, and establish healthy habits to get there.

This can be done by using SoFi’s Relay Insights and credit tracking tools.

Relay Insights allows you to connect all of your financial accounts securely via Plaid to SoFi so you can see everything under one pane of glass. As much as I love SoFi’s products, I still use other financial institution’s products for various reasons. I have multiple credit cards that offer me better perks on specific purchases, my mortgage is with Rocket Mortgage, and I have brokerage accounts that give me greater trading options than SoFi would (at this moment). Regardless of this, I can still sync all of these accounts up and utilize SoFi as my central hub for monitoring and evaluating.

When you first open up Insights you’ll be given the options to track your credit score, spending, and your debt.

After allowing credit monitoring, think of every asset and liability you have and follow the prompts to link them. These include:

Assets:

External Bank Accounts (SoFi products will automatically be linked)

Primary or Secondary homes

Vehicles

Investment / Retirement Accounts

Other Asset (Gold/Silver, Cash held outside of a bank, etc.)

Liabilities:

Credit Cards

Auto Loans

Personal Loans

Mortgages

Other Liabilities (Money owed to a friend / family member)

If anything is unable to be linked via Plaid, you can manually add an account but transactions won’t sync automatically.

Once everything has been added your financial picture will automatically be broken down under two screens: Summary and Net worth.

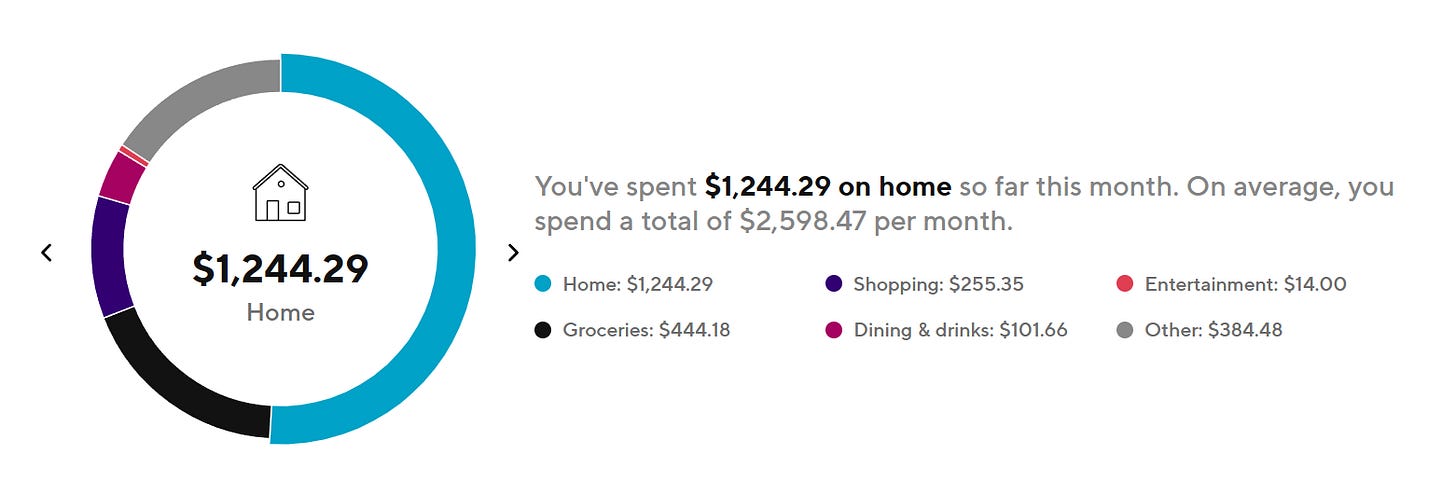

The Summary screen is going to break down your spending on a monthly basis, automatically detect recurring expenses, and show how much you’re saving. It’ll also show your total open balances on credit, your credit score, and your investment portfolio.

The Net worth screen will total up all of your accounts, and give you a chart of your current net worth. You’ll be able to see things like credit utilization percentages on your credit cards, and loan payoff percentage for your loans.

Okay cool so now here comes the shitty part (but still so much better than using a spreadsheet). SoFi does its best to organize your financial data the best it can, but sometimes it messes up. It might log a credit card payment as income or log an evening dinner date as a transportation expense. It all depends on how that transaction was logged on your financial institutions end, and how SoFi then interprets it when synced.

The data is only good if it’s accurate.

So let’s make it as accurate as possible, at least for the last 3 months. Here’s what I do:

It’s usually easier to do this in a web browser. Under Summary, go to the transaction history section.

Adjust the filter to only include one month and start going through each transaction to make sure it is logged correctly. You might find things out about your spending habits that you were completely unaware of. Like in my case, how I go to Starbucks too often.

Most of these are going to be obvious, a trip to Chick Fil A is a dining expense, a trip to the grocery store is a grocery expense, etc. Most of these selectable categories are expense related accounts, and are what get logged under the “Spending Categories” section.

There are three selectable categories however that do not get logged as expenses; Those are Income, Transfers, and Investments.

Income is obvious. You get a check from work, it’s income. This is what gets logged in the “Monthly Saved” section of the app. It’s going to take anything logged as income in your transactions minus anything logged as an expense.

Transfers and Investments are a little trickier. They are logged as neither an expense nor income.

Transfers signify money moving from one account to another, like from your checking to your savings account. Credit card payments are transfers as well. Take the Starbucks transactions above for example. Those were made with a credit card and are logged as an expense. Your payment to pay off this balance is just a transfer of money from one account to pay down the balance of another. I bring this up because I often see these payments getting logged incorrectly and these two categories in particular will really throw off your data if wrong.

Consider the investments category just the transfer of money into another store of value. If I buy $200 of SOFI shares, I would still have $200, it just wouldn’t be in US Dollars anymore.

Transfers and Investments are just placeholder transactions that represent money moving from one asset to another.

Here are some examples of data that relay logs wrong, and I routinely fix:

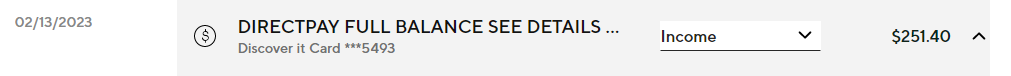

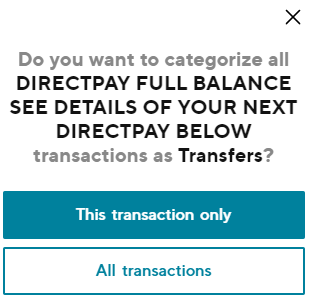

This credit card payment was logged by SoFi as income. This needs to be changed to Transfers.

You have the option to log any future transaction labeled the same as a transfer in the future by selecting “All transactions” when saving the change. Whenever SoFi sees a payment on your credit card it will be logged correctly from now on.

Here’s another example:

This frozen yogurt order got categorized as groceries. This needs to be changed to Dining & Drinks.

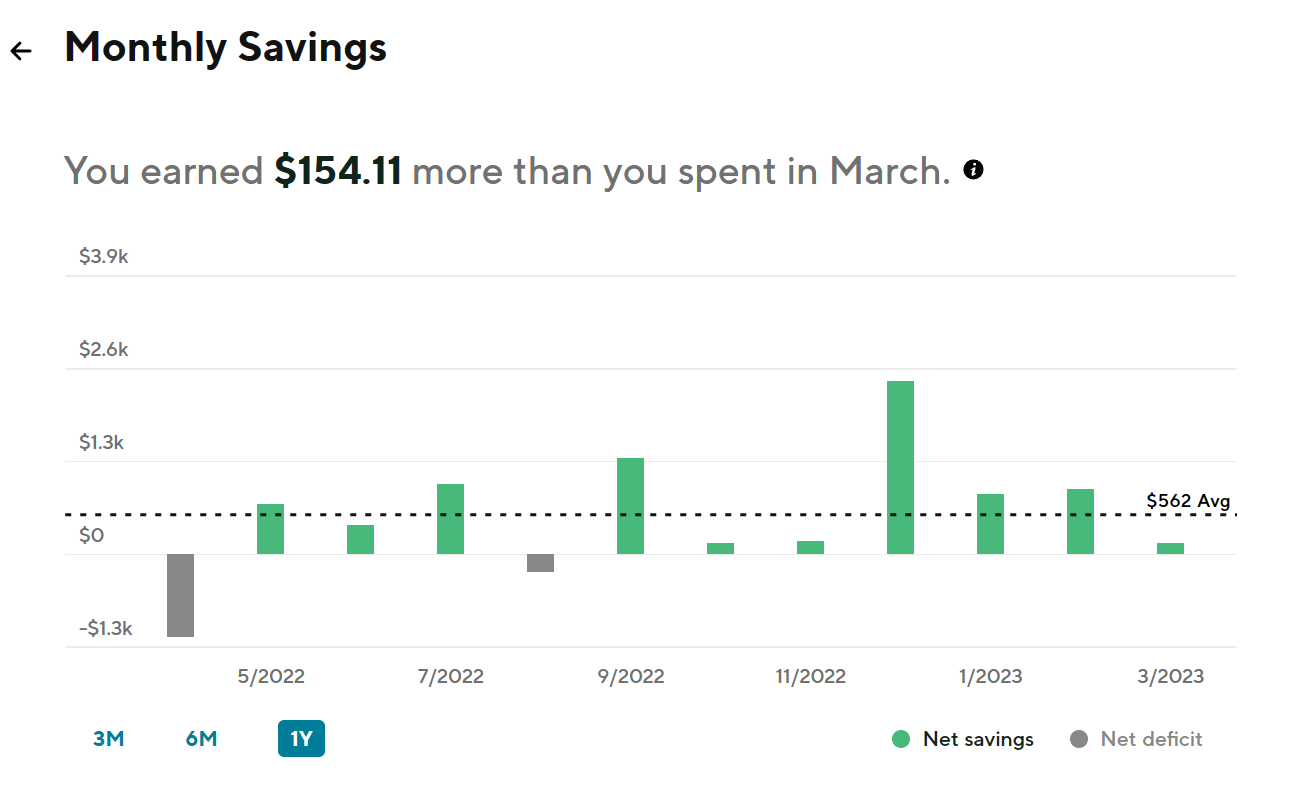

You get the point. Now that we have accurate data we want to look at the Monthly Savings section. If it’s green across the board bravo you have made it past step one of creating a money move mindset.

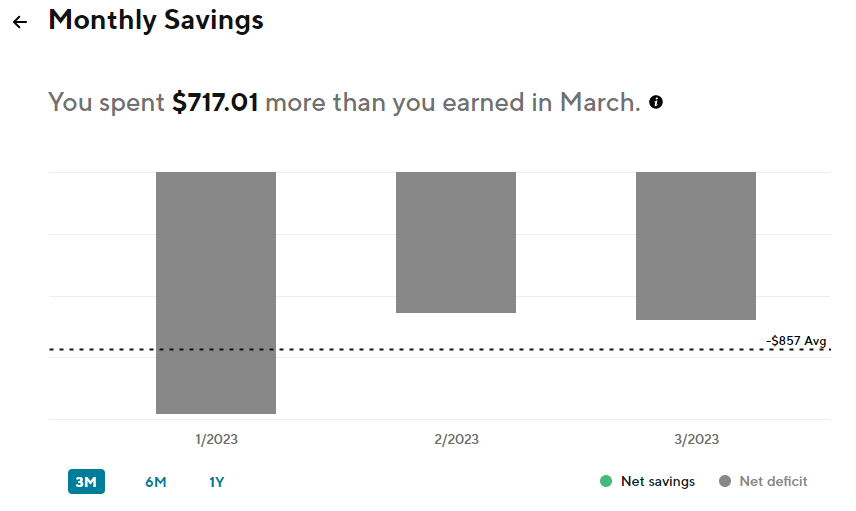

If it looks like this we have a problem.

In order to get to the next step of making more than you spend it’s required that you, well, make more than you spend.

I won’t tell you what to do to fix this problem, as what works for me won’t always work for someone else. I take a deeper look at this in another article here:

In this article I break down the formation of habits, and offer some suggestions based on what kind of person you may be with money. Whether that’s a spender vs a saver, impulsive vs disciplined, or a risk taker vs risk averse, etc. It may be worth a read!

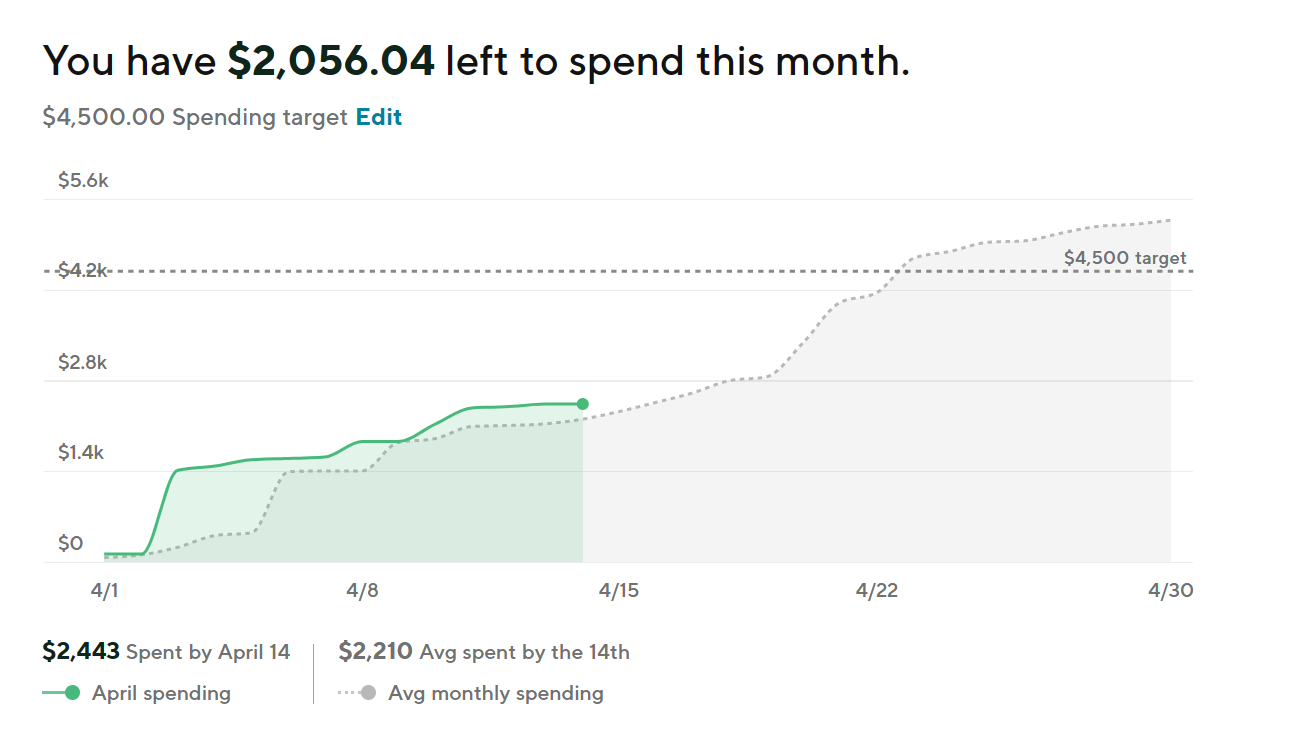

I personally don’t budget. I set a spending target each month, and periodically check to make sure I’m trending to be around that number. Then I align my spending to what I value, which again is a personal preference thing. Some people value Starbucks on a Saturday morning more than others, and that’s fine. We aren’t trying to be like those people on TLC that only flush their toilets once a week to save on water costs. Spending targets are actually another feature under Relay Insights if it’s something you want to consider.

You’ll be able to check here periodically to see if you are on track or pacing high.

A good evaluation method for determining how much you value something though is measuring it in time spent working to purchase it rather than dollar amount. If you’d rather have the free time back than work to afford it it’s probably not that valuable to you.

Here are some things that should be universally valued in order:

Rent/Mortgage - Need a roof over your head

Groceries - Need food in your stomach

Essentials (Utilities, Power, Water, Heat, etc.)

Income earning expenses (Transportation, Internet, Phone, anything needed to continue earning income)

Minimum payments on all loans

Make sure these are paid first over everything else and then evaluate what’s left. You can hop over to the Spending Categories section to get a breakdown of where your money is going which may be helpful when making these determinations.

Identify areas of lesser value to you and cut those first. For example, if you notice you’re spending too much on Coffee in the morning at the cafe, consider making coffee at home.

Small purchases add up quickly. A $5.00 coffee everyday before work is over $1000 a year. Same thing could be said about recurring subscriptions. Maybe you are paying for something like the gym or Netflix and just don’t use it, cancel it. In fact, according to a Hiatus survey, 62% of consumers waste money on unwanted subscriptions because they don't cancel automatic renewals. Simple changes like this can go a long way in helping you reach your financial goals.

You can use the Recurring Expenses section in Relay Insights to quickly identify these subscriptions.

Really this step is mainly habit building and with that it is incredibly beneficial to come back and evaluate routinely. On a monthly basis I come back into Insights and go through every transaction that month to make sure it’s organized accurately. Then you can look at the other sections like spending categories and monthly savings to see how you did for the month. This is a really good way to track your progress towards your financial goals and quickly pivot if needed.

Once you’ve begun making more than you spend you’ve made it to step 2.

Making more than you spend:

First thing we want to do when we get here is eliminate the problem we identified at the beginning of this article. 56% of people can’t cover a $1000 emergency bill. Let’s be a part of the 44%.

All of that money left over each month should go towards a $1000 starter emergency fund. This is a break glass account that only exists to cover your ass when the inevitable happens.

When your car breaks down, or you have an emergency health bill, or whatever else could happen, you’ll thank past you for covering it rather than future you covering it with debt.

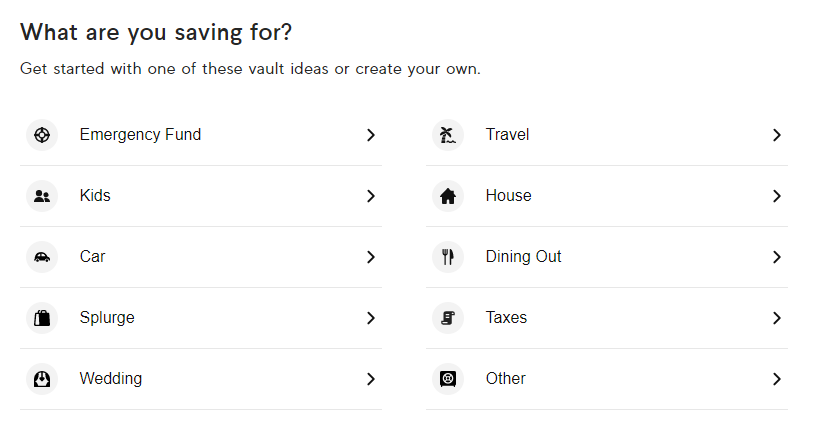

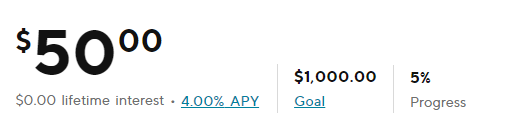

Now this is the part where SoFi’s other products, banking in particular, come into play. Although not required, it makes sense to keep your emergency fund where it’s highly accessible and makes the most money for you. SoFi’s Savings accounts offer 4% interest (with direct deposit) and have a feature called Vaults that would be perfect for this kind of savings goal.

The process is easy, you just select what you’re saving for and type in the amount you want to save.

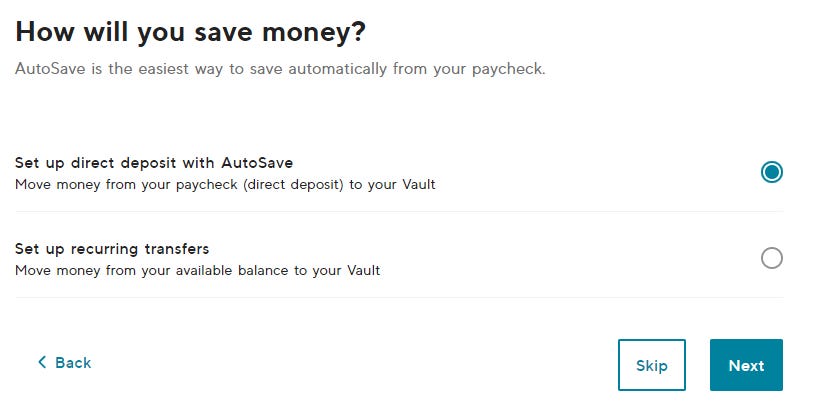

You can then set up Autopilot features like automatically saving a set amount from each direct deposit, or automatically transferring on a specific day each month.

You can even use a feature called Roundups which will automatically round up your purchases made with your debit card to the nearest dollar amount and deposit it into your vault.

Once it’s created you’ll get to see a progress tracker showing how close you are to reaching that goal.

So again, not required, just my personal opinion that it’s one of the best savings accounts out there.

So you’ve got your starter emergency fund, now what?

In order to reach the next step of borrowing from others responsibly, you have to get rid of any bad debt first. Usually the rule of thumb is anything that has an interest rate over 7% is bad debt with the main form being credit card debt. Good debt revolves around things that increase your future net worth like mortgages, business loans, and sometimes even student loans. Take the positive cash flow that you were putting towards your starter emergency fund and start making extra payments towards your bad debt.

There are two main ways to do this, the snowball or avalanche method.

Snowball Method:

Organize your bad debt by the amount owed. Flashback to step one, all of these accounts should be listed under your net worth section in SoFi Insights.

Take the money you’ve been putting towards your emergency fund and add it on top of your minimum payment of your SMALLEST debt.

Once fully paid off, take the money previously used – the minimum payment + the extra – and put it on top of the minimum payment of your next smallest debt.

Avalanche Method:

Instead of organizing your debts by smallest size, organize them by highest interest rate. Pay off the highest rate debt first, and then roll over the payments to your next highest rate.

Whichever method you choose is completely up to you as they both lead to the same end goal of being able to now borrow responsibly.

Borrowing from others responsibly:

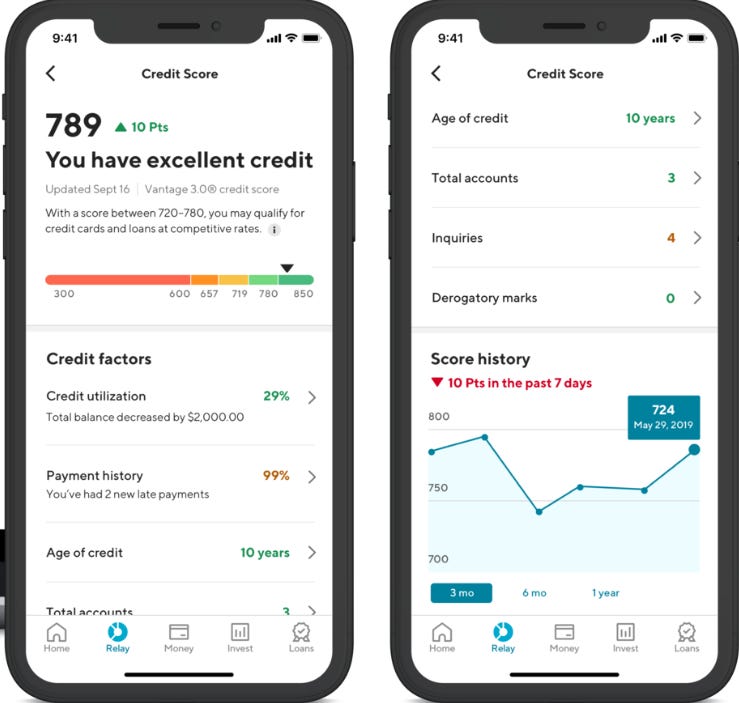

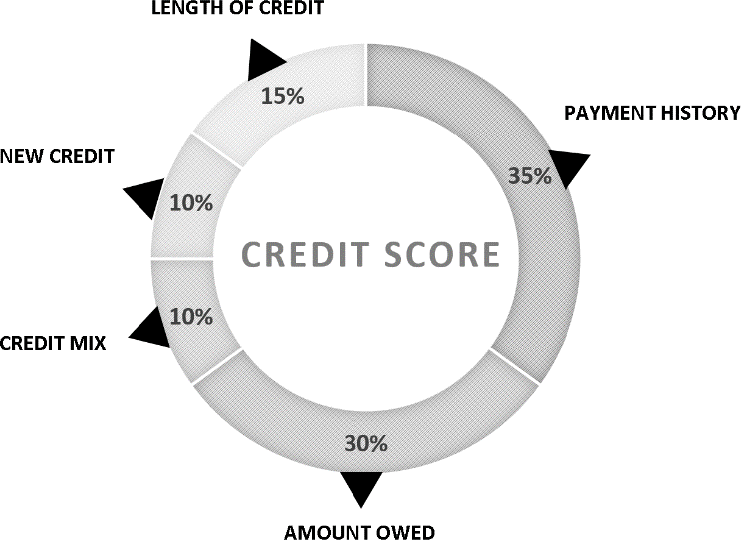

Getting rid of this bad debt will start to improve your credit score, which is the lifeblood of borrowing responsibly. Having a higher credit score will open up better opportunities with lenders for more favorable terms and lower interest rates.

SoFi’s credit tracking tool within Insights is super helpful for identifying areas of improvement.

These are weighted by importance, with payment history being the most important factor in determining your score. Here is the importance of each category:

Having and maintaining an excellent credit profile will prepare you for opportunities that revolve around good debt. Pair this with the added flexibility in how you allocate your savings since not having that car payment or credit card debt anymore allows you to save even more each month. You will be able to expand your savings vaults to things outside of just an emergency fund. This could include things that could potentially expand your net worth like the down payment for a home purchase, starting a business, or self-improvement like going back to school. But also, for things that would have previously put you in bad debt before, like vacations, a wedding, a car, etc.

I won’t dictate what those goals should be, but I would recommend that you continue growing your emergency fund to equal at least 3-6 months of your essential expenses. This is to give you extra coverage and peace of mind in case you lose all sources of income, or run into a major emergency expense. I’ll cover another recommendation, investing, in the next section which is essential for preparing for retirement.

You can have up to 20 vaults though so go crazy if you want.

I also want to add here that I don’t think credit cards are evil, and you can use them responsibly. In fact I’ve never used my debit card in my life. As long as you have a strong money move mindset and set up your statement balance to autopay each month, you’ll never go into debt and you will never be charged interest. What you will get is the benefits that come with credit card purchases, for example SoFi offers 2% cash back on every purchase with their credit card. It’s a nice way to get paid for purchases you were going to make anyway, and a great way to build a good credit profile.

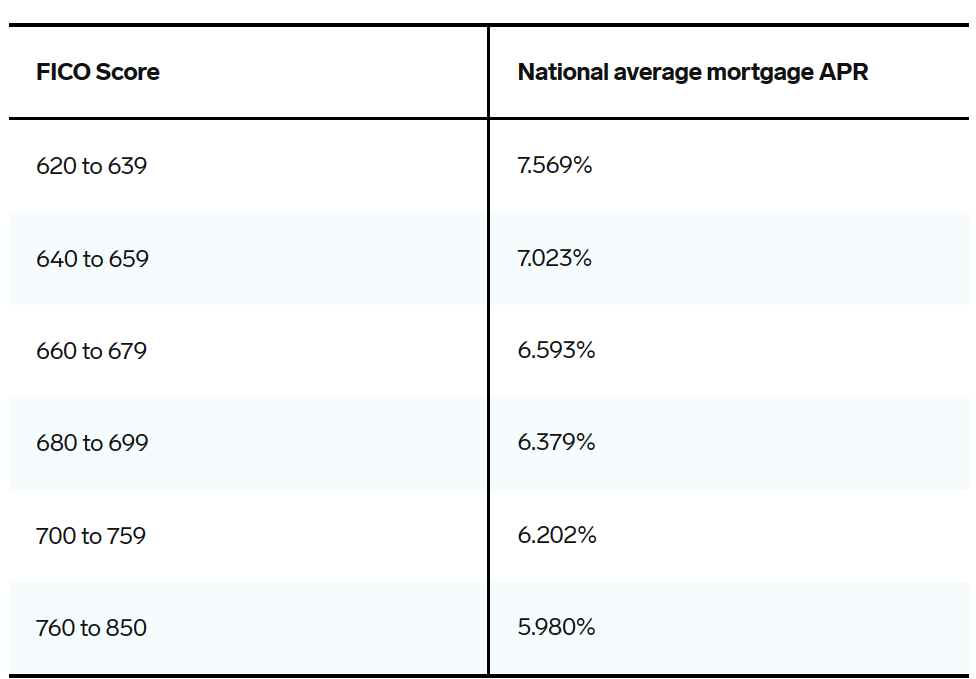

I’ll end this section with a great example of good debt, when done right, and a goal that most people will have in their lives: Buying a home.

These are the current average rates for home loans by credit score:

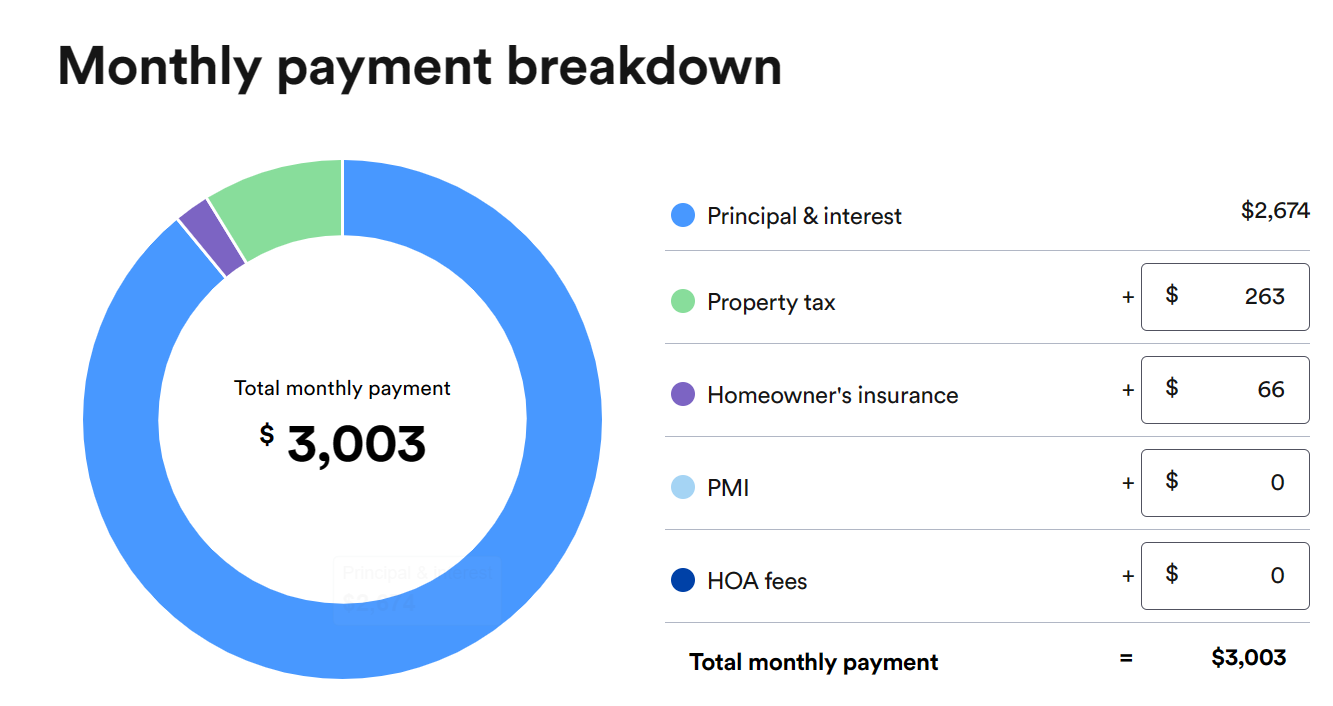

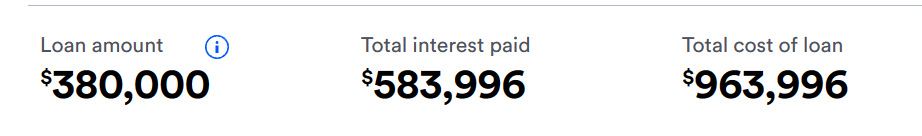

Here’s why it’s important. If you were to take the highest rate on this schedule and apply it to the same Home Loan ($400,000 purchase with $20,000 down):

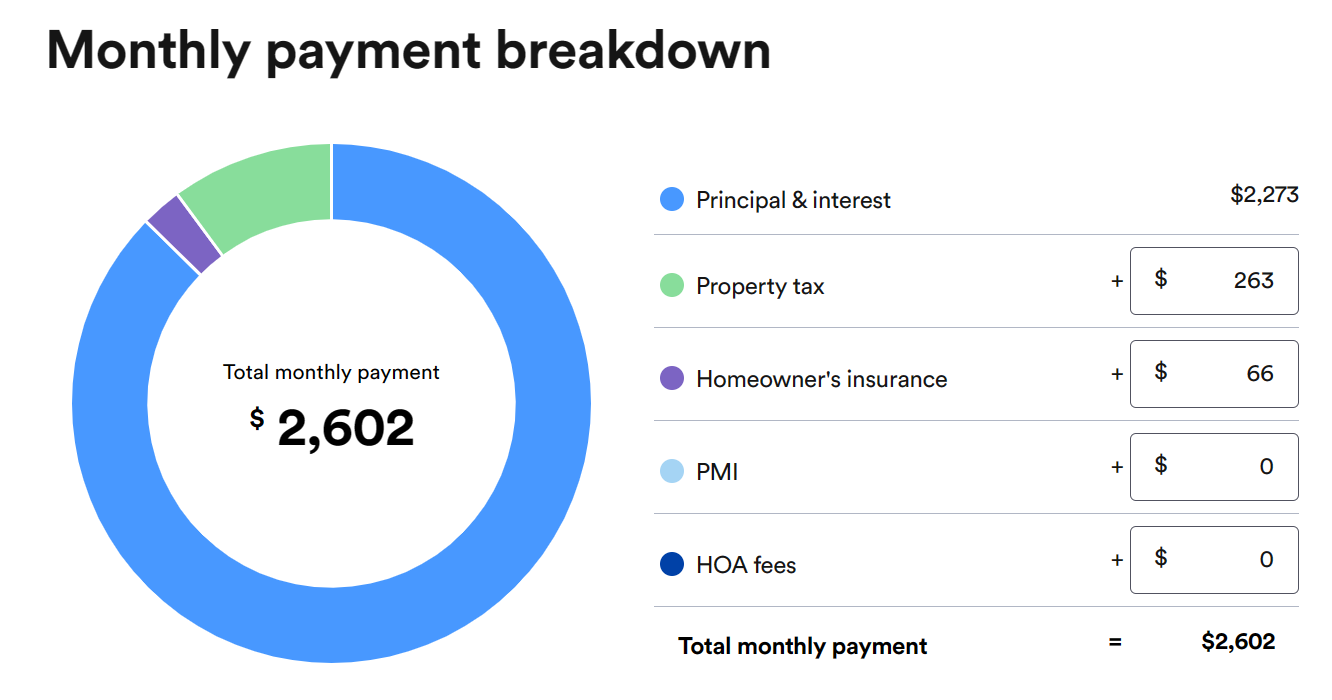

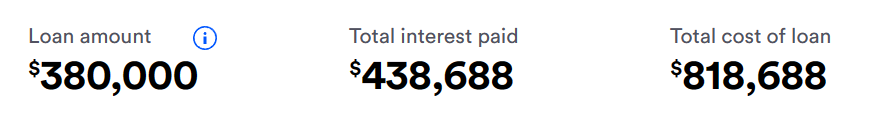

Now consider the lowest rate on that scale:

You’re saving $150,000 dollars over the life of the loan, and your mortgage is $400 dollars cheaper per month. Maintaining a good credit profile would allow you to take this extra $400 dollars and apply it to the next step.

Investing what’s left over:

At this point you should have all of these things:

Oversight of all of your accounts from one pane of glass

Aware of how much you are spending and saving per month

A significant emergency fund saved

No bad debt

With these you should have relative financial peace of mind, but right now this is all possible because you are earning income. Eventually you won’t be able to earn income anymore, or you won’t want to as you enter retirement. Investing is essential for maintaining this same financial peace of mind when you no longer want to work.

According to a recent survey done by Clever, retirees only have $170,000 available for retirement with half believing they are going to outlive that amount. 75% have bad debt, 40% have nothing saved at all, and 70% wish they would have saved more. This is a recipe for a stressful retirement or no retirement at all.

To avoid this we want to leverage the power of compound interest through investing. Here’s why:

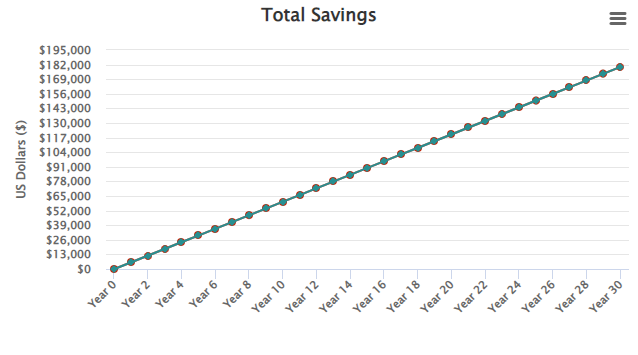

Saving $500 a month for 30 years in your sock drawer.

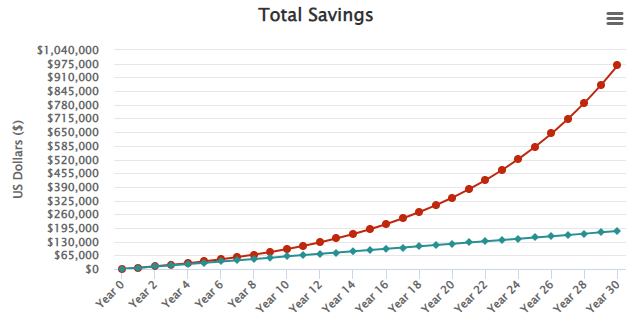

Investing $500 a month for 30 years in the S&P 500.

Big difference.

One of the simplest and effective ways to do this is to leverage employer sponsored retirement plans like a 401k. Especially if they offer an employer match on your contributions. Take these contributions and invest them in index funds that cover the entirety of the U.S. Stock Market. As shown in the example above, doing this would have netted an average return of just about 10% a year. Nothing fancy about it and anyone can do this.

If your employer doesn’t offer any retirement plans, you can still do this by opening up an individual retirement account. This is something you are able to do through SoFi with the choice of self directing your investments, or automating it.

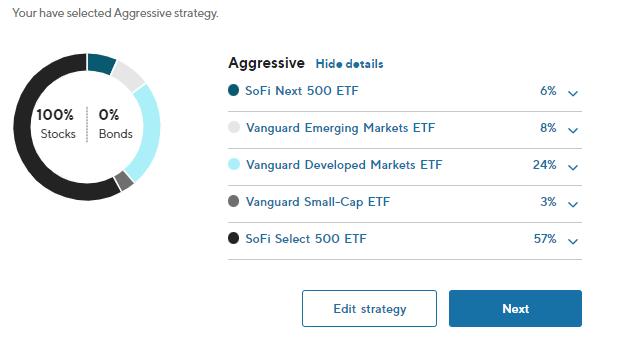

After answering a few questions about your investment goals SoFi will automatically tailor a portfolio for you.

You select how much you’d like to invest per month and it will automatically go into these funds.

It doesn’t get much easier than that.

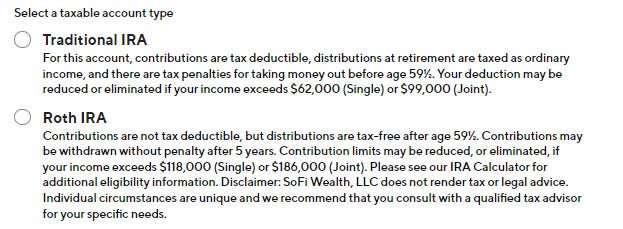

Retirement accounts do come with tax advantages, but also carry some restrictions and limitations. It’s important to determine which to go with based on your circumstances and understand that you won’t be touching this money until you’re 60 years old.

Here are the primary account types:

If this is all sounding complicated the good news is that SoFi offers complimentary financial planners to their members who can help you make the right decisions based on your goals. These are non-commissioned employees held to the fiduciary standard. That means that they are legally required to only make recommendations with your best interests in mind.

Let compound interest do its thing and you’ll have enough to retire and live off these investments.

Again, all of the tools needed to be financially successful are available in SoFi, which is why I use their entire stack of products. You’re able to track your entire financial picture via Relay Insights, identifying how much you are spending and saving each month. With those savings you can organize your money in vaults and earn an industry leading 4% APY with direct deposit. With that direct deposit you get paid 2 days early and can automatically transfer money into your robo advisor investment account. The ability to have everything in one spot really simplifies money management. If for some reason you read this entire article, I hope you found something useful from it.

You can connect with me on Twitter here:

@DanielRKlaas

If you want to read my deep dive into SoFi from an investor perspective, you can read that here:

Disclaimer: I am not a financial advisor. The contents of this article are for educational purposes only and cite my own personal opinions.