How important are student loans for SoFi?

Quick thoughts on the student loan pause ending + SoFi At Work.

“SoFi is just a student loan company.”

Apparently, this is still true, but at least this time I’m not as mad about the price action. After it was announced that the debt ceiling bill would officially end the student loan pause, SoFi stock has gone nothing but up.

I know we don’t like to agree with the sentiment that SoFi is just a student loan company, but I want to give the people who say that a chance. Maybe there is some validity to it. Just how significant are student loans resuming to SoFi’s overall business now?

SoFi has been operating the last 3 years with one hand tied behind their back. I mean there is a reason they are known as a student loan company, because that used to be their bread and butter. In fact, back in 2018 basically all of SoFi’s revenue came from their lending segment and student loans comprised over half of their originations. I’m ripping this straight from Data Driven Investing’s article who did some excellent work on this subject. You can read his article here:

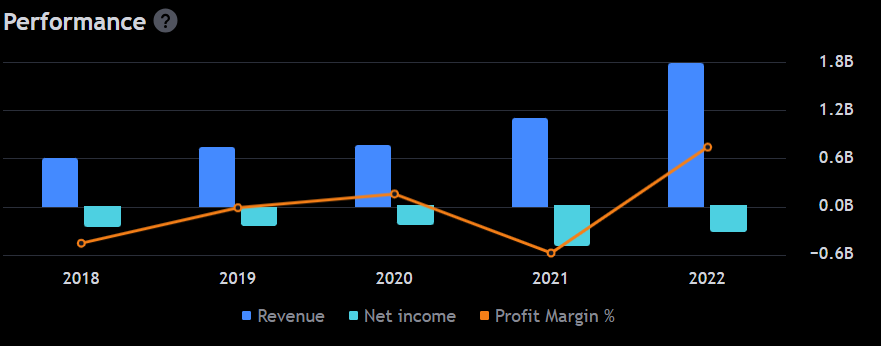

We know SoFi looks a lot different now. In 2018, SoFi didn’t have a bank charter and they didn’t own their full tech stack in Galileo / Technisys. They were just starting to build out their financial services platform that we know today. SoFi now operates three successful businesses under one umbrella, and despite the student loan pause they have continued to scale and grow revenue at a significant pace.

Chart taken from TradingView

SoFi is doing great without student loans, so why do they need them?

I want to touch briefly on the refinancing opportunity first, but there is another piece to this, which I think may be equally significant and that’s the continued adoption of SoFi At Work.

How big is the refinancing opportunity?

Noto was actually just asked about this at the Piper Sandler Global Exchange yesterday, so I’ll let him answer that question.

“In front of us, we think there's about a $200 billion adjustable market for the credit box that we serve that would be in the money and that's a sizable opportunity. We think there will be two underlying value props for people. Some people will choose to refinance at a lower rate, and some people will choose to refinance at a longer term.”

Basically, the immediate market opportunity is $200 billion that people could refinance and save on. Either by lowering their rate, or by expanding their loan length. Refinancing also opens the door for cross selling these people any of SoFi’s other great products. I won’t go into detail about the financial implications of this since Data Driven Investing has already done all this work. To quote him here:

“The baseline numbers, which I’d argue are still very conservative, would result in an incremental $470M in revenue for FY2024 and $40M per quarter in EBITDA (and hence, net income). As a reminder, SoFi is expected to only be at $2B in revenue for FY2023, and had only -34M in GAAP net losses. Analysts are forecasting $2.46B in revenue and an EPS of 0.00 for all of 2024. In other words, with the baseline scenario, student loans alone would result in SoFi beating analyst expectations for 2024.”

This assumes all other business segments grow flat for the full year. Highly unlikely.

There is another piece here that I think is equally important outside of just the refinancing opportunity, and that’s the adoption of SoFi At Work. As of the first quarter of 2023, Americans owe over $1.78 trillion in Student Loans. Here’s how SoFi captures more of that market.

What is SoFi At Work?

SoFi At Work is basically the SoFi platform you know of with a few extra products and features bundled as an employee benefit package. Here’s a quick breakdown of the product from SoFi:

It offers employers some unique options to offer financial well-being to their employees. SoFi's market pitch to employers is that if you help employees with their financial stresses in life, they’ll spend less time worrying about them and more time adding value to your company. It’s a really good way for SoFi to reach their target demographic (high income, not rich yet) while they are growing in their career.

When SoFi At Work originally launched back in 2016 it offered two features, student loan contribution benefits and student loan refinancing with no fees. These are still the main benefits offered by SoFi At Work. The program essentially gives employers an easy way to help employees pay down their student loan debts. In addition to these programs, SoFi At Work also offers these benefits to employees:

529 College Savings Plans

Employer contributions to emergency fund vaults

Free financial planners and financial learning resources

Insights into their financial picture, including credit tracking and debt repayment tracking

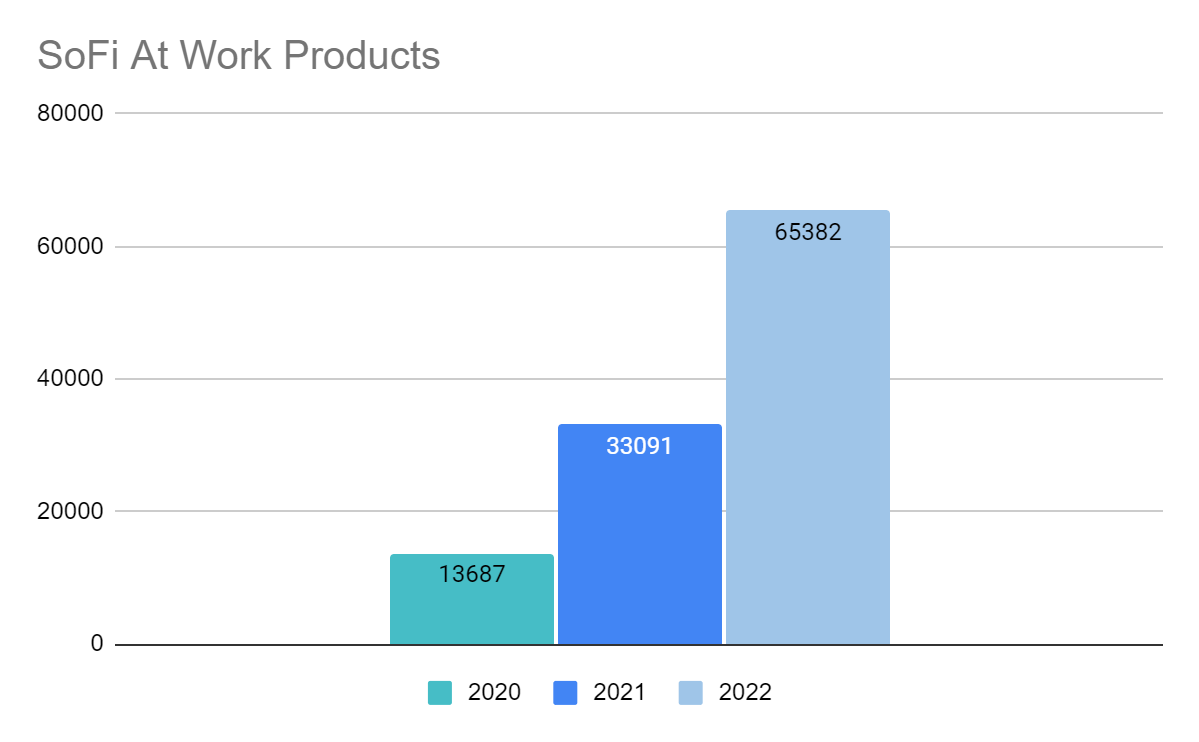

Despite the student loan pause and the lack of urgency for employers to provide the main student loan contribution benefits, SoFi At Work products continued to grow at a fast pace the last 3 years.

This is now changing and I’m excited to see what kind of difference it will make for SoFi At Work adoption. The even better news is that these products are fully built already, they have just been on stand by mode. Even though SoFi’s refinancing opportunity is around $200 billion, the other $1.5T will still need to be paid back regardless. With the added pressure of payments resuming, demand for these products should only go up.

But wait there’s more.

There have been some significant changes made to employer retirement contributions recently with the Secure 2.0 Act of 2022 getting signed by Biden at the start of this year. The most important change though for SoFi has to do with student loans. Before this law went into place, employers could only make matching contributions to a defined retirement plan, like a 401k. If I’m sitting around with six figures in student loan debt, the last thing on my mind is going to be contributing to my retirement plan. I’m more focused on paying down that debt bill, and freeing myself of it. Ultimately this leads to the younger generation missing out on years of compounding in the market, which significantly impacts their long-term retirement savings.

Well, this is changing. Starting in 2024 employers can begin matching their employees' student loan payments and allocate the funds to their retirement plan. Eligible employees just need to certify their loan payments on an annual basis. Guess who is already at the forefront of this change.

SoFi announced today a new product for SoFi At Work, called Student Loan Verification.

“The service provides a low-cost way to verify eligible student loan payments and deliver contributions for retirement matching – all employers need to do is determine employee eligibility based on student loan debt balances. From there, SoFi at Work handles the rest, including plan design, data security, and reporting.”

This is just another example of why owning the tech stack is so important for SoFi. They can innovate and build products in real time. If employers are looking to offer this type of benefit to their employees, it makes sense to go with the vendor that does it best. This just expands SoFi’s cross selling capabilities to a whole new level.

So no, SoFi is not just a student loan company, but their target customer is likely to have student loans. They have grown perfectly fine without student loans but having them back I think sends their customer reach into overdrive. It will be interesting to see how things play out, but 2024 is looking bright.