SoFi Overview

Before investing in any individual company, I aim to answer six questions.

What does the company do?

How did they get to where they are at today? (History)

What makes them unique? (Moat)

How is their unique proposition working out for them? (Financials)

What does the future hold for them? (Forecasting)

How does it go wrong? (Risk)

Figured it might be helpful to other investors to post the answers to those questions publicly. If you do find this to be helpful, please consider subscribing for future overviews and other articles. This content will always be free as I do this work for my own understanding and for fun.

That being said, here are my thoughts on SoFi.

What is SoFi and what do they do?

Most know them as a student loan company, but this hasn’t been true since the Government decided people no longer needed to pay their loans 3 years ago. Lead by Anthony Noto, SoFi pivoted from being primarily a student loan financing company to a full-fledged vertically integrated financial services company. From a member perspective SoFi offers leading APY on Checking and Savings with no fees, a 2% cash back credit card, a simple to use Invest platform, financial insights to all your accounts, and same day funding of personal loans. All products are tied together through a top notch reward system bolstered by SoFi Plus for Direct Deposit holders. From a behind the glass perspective, SoFi utilizes their own tech stack to power a large chunk of other financial platforms such as RobinHood Cash Management, Chime, Dave, and others. As more money is drawn from the conventional banking system and moved into a non traditional account, SoFi is positioned to capitalize on this regardless of if the money is deposited into SoFi Bank or not.

How did they get to where they are at now?

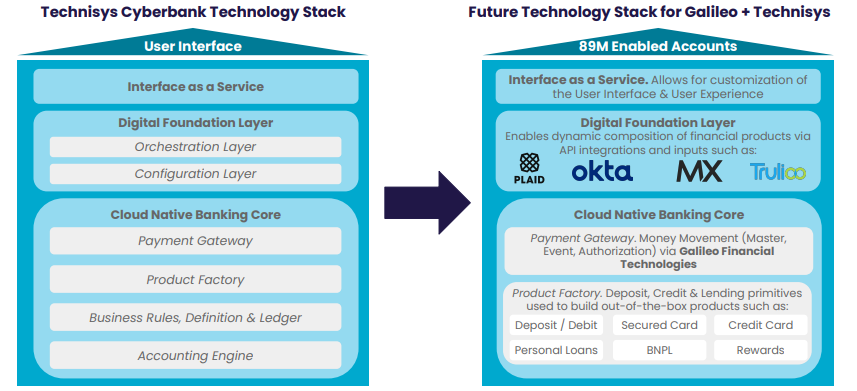

SoFi was founded in 2011 by a few Stanford students as an alternative way to provide affordable options for funding college. It wasn’t until early 2018 that SoFi began to pivot with the hiring of Anthony Noto as their CEO. New financial services such as SoFi Money, SoFi Invest, and SoFi Credit Card were introduced to members seeking to improve their financial lives outside of just lending options. SoFi then made a ballsy acquisition in April 2020, buying Galileo Financial Technologies for $1.2 billion dollars, allowing them to own the API and payment platform their products were built on.

Soon after buying Galileo they announced they would be going public through a Chamath SPAC $IPOE, with the promise of becoming the AWS of Fintech. This is primarily where they get their reputation for being a meme stock, but I won’t get into that. Shortly after becoming a publicly traded company, SoFi completed the acquisition of Golden Pacific Bancorp giving them the coveted bank charter they had longed for. We will go over why that is so important later on in this article. A month later they acquired another piece of their technology stack, Technysis for 1.1 billion dollars, creating the first fully vertically integrated financial services company in the world.

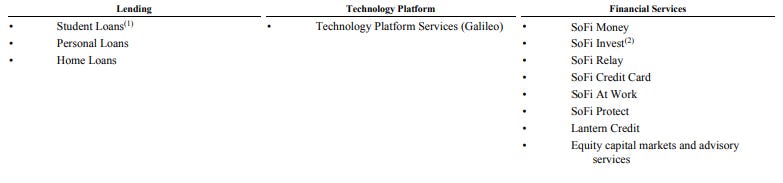

Basically SoFi spent about 3 years putting all the pieces together and are now poised to execute and refine. Here is the picture today:

What makes SoFi Unique?

The financial space is a hyper competitive and saturated space to be in and SoFi knows this. There are thousands of banks and fintechs all fighting for the right to be the place you deposit your paycheck, or the card you reach for when buying something, or where you take out your next loan. The other thing working against them is that it’s never been easier to move money between institutions. In fact I was able to switch my primary bank from Discover to SoFi all from the comfort of my own home, without any human interaction. How does SoFi take and retain market share from all of these competitors, in other words, how is SoFi sticky? Well they are able to do this in multiple ways.

SoFi’s bread and butter is being a “One-Stop-Shop” for any of your financial needs, and to be there for any moment of your life. Whether that’s a spot to deposit your first paycheck, fund your higher education, or buy your first house. If all the products exist in the same spot then there is no reason to go anywhere else, unless of course the products themselves aren’t the best. SoFi was able to demonstrate their ability to create best of breed products with their only a year old Checking and Savings product which won these awards:

GoBankingRates Best Banks 2023:

● Best Online Bank

● Best Neobank

● Best Savings Account

● Best Checking Account

Nerdwallet Best-of Awards 2023:

● Best Checking Account Overall

● Best Checking Account for High Interest

● Best Checking Account with No Monthly Fee

● Best Checking Account for Overdraft Fee Avoidance

● Best Checking and Savings Combo

Money.com:

● Best Banks 2022 – 2023

Motley Fool Ascent’s 2023 Awards Winners:

● 2023 Bank and Bank Account Awards

● Best Digital-Only Bank

SoFi is able to build these best of breed products by leveraging their fully owned technology stack and bank charter.

I think it’s easier to explain this with an example. SoFi provides one of the highest APY yields on Checking and Savings accounts (1.20% and 4.00% at the time of this article). The average savings yield as of March 8th 2023 according to Bankrate is 0.23%. Here’s the crazy thing though, even with this incredibly high yield it actually is saving SoFi money. Before becoming a chartered bank SoFi had to use warehouse funds, which are a kind of debt financing provided by actual banks, to then use to fund loans for their members. The bank charter allows SoFi to use member deposits instead which according to Noto saves them around 185 basis points in loan costs. That is substantial.

As far as the technology stack is concerned we can use the introduction of SoFi’s BNPL program Pay In 4 as an example. SoFi is the first Bank to leverage Mastercard’s installments program to offer instantly funded virtual cards with four 0% installments. This functionality was the first product built together with Galileo and Technisys, which can now be packaged and sold to their other banking customers. The same can be said for fractional share purchasing or IPO access to retail investors. SoFi is able to build new products and innovate as they feel fit which is a huge advantage.

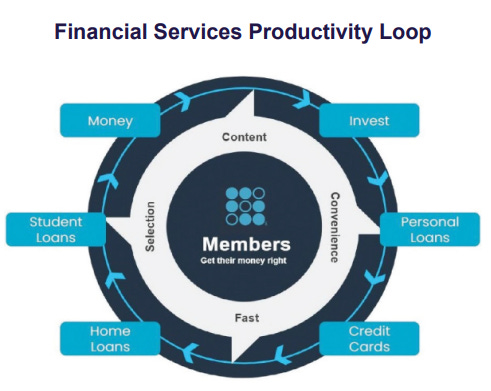

SoFi then can utilize it’s SoFi Plus membership as a mechanism to retain Direct Deposit holders and cross sell different products. Direct Deposit is the key that changes a new account to a long term primary relationship with the bank, it’s important. In SoFi’s latest earnings call Noto stated that around half of newly funded SoFi Checking and Savings are signing up for Direct Deposit by day 30, and that 85% of deposits are coming from direct deposit members. This is the funnel that really powers the financial services productivity loop. Members set up direct deposit to take advantage of the benefits of SoFi Plus (See Screenshot) and SoFi retains these direct deposit members by offering more benefits as new products are developed on their tech stack. For example, Pay in 4 is only available to SoFi Plus members. Then SoFi is able to take these predictable member deposits and use them to fund loans.

How is this working out for them?

I’ll let these charts answer this question:

SoFi Sales vs Analyst Estimates

SoFi EBITDA vs Analyst Estimates

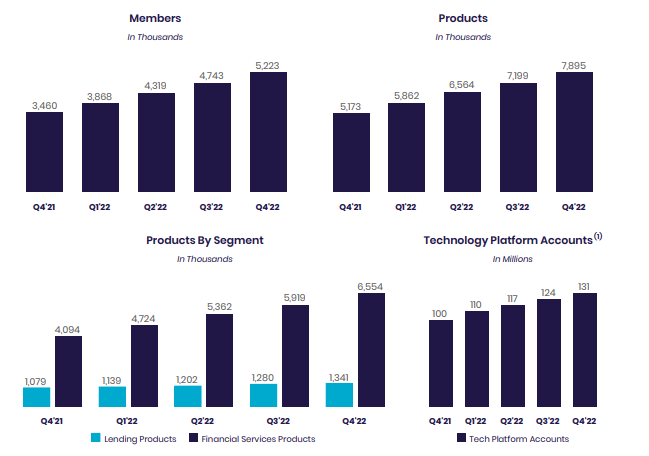

Members and product usage are growing 50% YoY, so people clearly like the platform. SoFi continues to beat analyst estimates quarter after quarter with a record 457 million net revenue Q4 2022, up 60% YoY, and adjusted EBITDA $70 Million which was a 15.3x YoY increase. Things appear to be going as planned.

What does the future look like for them?

Big picture here is the guidance provided directly by SoFi Q4 2022.

For the full year 2023, management expects adjusted net revenue of $1.925 to $2.0 billion, up 25% to 30%, and full year adjusted EBITDA of $260 to $280 million. Management expects to reach quarterly GAAP Net Income profitability by Q4 2023.

Based on past reports SoFi definitely has a pattern of under-promising on their guides, and beating estimates. It is safe to assume they are being conservative here as well. This is also assuming student loan payments do not resume for the full year, but we know this issue is currently being decided by the Supreme Court. Hopefully these loans resume Q3 of this year, which should be a nice boost for loan originations.

Here’s what we do know is coming:

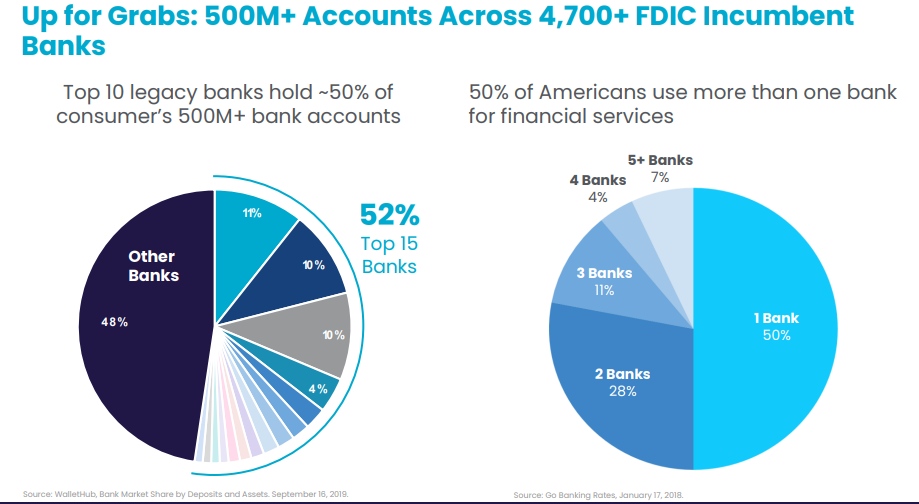

SoFi officially has their suite of products built and all that is left to do is scale and innovate. There are currently over 500 million accounts available to pull away from the competition, and SoFi has already shown their ability to get users to switch. Deposits have ballooned to over 7 Billion dollars in the first year of becoming a bank and this should continue to grow.

As far as the innovation side of the equation I don’t want to speculate too much about unreleased products but here are some examples and likely product expansions within the Financial Services segment:

Within checking and savings pay-in-4 will be made available to all SoFi Plus members, but it may also expand it’s limits and it’s uses. Autopilot is likely to expand to offer more automation processes tied to Direct Deposit. Right now members have the ability to split paychecks into Savings vaults or use round ups, but this is likely to be expanded into Invest. (This already existed for automatic crypto purchases, but was removed due to regulatory concerns). The credit card platform will most likely begin to offer custom experiences for members through shopping portals. There are already reports of SoFi travel being in beta. SoFi Invest should be receiving a UI overhaul and Level 1 options are also on the roadmap. With the promise of “Better together” and owning the tech platform these products are built on, it seems likely SoFi will continue it’s pattern of building innovative and creative services. SoFi is going to continue to integrate their existing technology onto their Galileo + Technisys stack. So yes innovation will be quicker but also SoFi expects to save about $75 to $85 million in total from 2023 to 2025 and about $60 to $70 million every year after. Savings that can be leveraged to offer even more competitive products and undercut competition.

Honestly though I think the most exciting part about SoFi’s future is the growth of the Tech platform.

To understand why the tech platform is so compelling you have to first understand what SoFi has built.

SoFi is a fully chartered bank. Other companies wanting to offer financial services either need to be chartered themselves, or partner with a chartered bank. They have to do this to meet regulatory compliance requirements such as consumer protections, data security, and deposit insurance.

SoFi owns the payment processing technology through Galileo’s APIs. This is required to facilitate the movement of money between financial institutions.

SoFi owns the Banking Core and on-glass digital services that customers interact with through Technisys. This is required to manage your company's operations such as accounting, reporting, compliance, customer service, etc.

All of these pieces are built to work best with each other, but can also be used by themselves.

So here’s the proposition:

The pandemic accelerated the transition from traditional in-branch banking to digital-centric experiences. This trend of course is going to continue, and small regional banks will have to adapt or fall behind. The existing infrastructure these banks use typically can’t support the new services customers are looking for, so Technisys stands to capitalize on this. Cyberbank Core and Digital offer a fully built out of the box experience for traditional banks to migrate their existing systems to. Galileo will then become the natural suiter for payment processing for these institutions.

Juan Francisco Fernández, Co-founder and CEO of Crediclub, added: “For us, the Technisys merger with SoFi and Galileo is significant and decisive because it shows that Cyberbank is the technology of choice by prominent fintech companies in the world and will strengthen customer-centric innovation for many more years.”

So that covers Technisys’ growth among a changing financial world and the synergies that are created with Galileo, but what about SoFi’s bank charter.

There is an incredible opportunity for SoFi to leverage it’s own bank charter to be the sponsor bank for commercial partners. Anthony Noto has already alluded to this saying “SoFi Bank could be the sponsor bank to commercial partners, enterprise partners and have a 10-to-12-basis-points advantage, because we are the sponsor bank on top of the fact that we're also a payment processor,"

So according to Noto it would be cheaper for institutions already leveraging Galileo’s services to also use SoFi Bank as the issuing bank. This would open up another revenue stream for SoFi and allow them to collect a bigger chunk of interchange fees from Galileo clients.

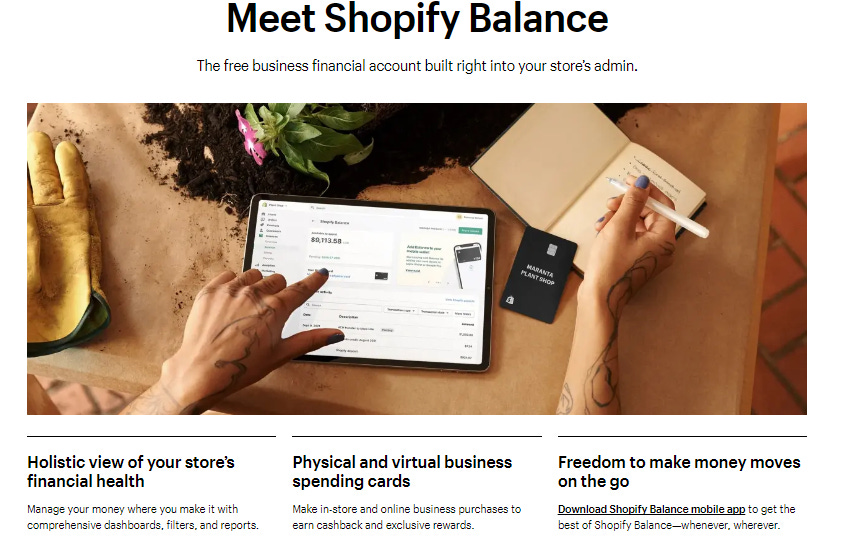

But there is an entirely different segment of financial services SoFi is looking to lead, and that’s the world of embedded finance. Michael Haney, Head of Digital Core at Technisys, has already stated this is the next phase in banking innovation. It basically means bringing banking services to the point of need. An example of this would be BNPL services like Paypal or Klarna being embedded in the check out process for retailers, or platforms like Etsy or Uber offering banking services for their merchants / contractors. Platforms such as Shopify are already doing this, offering banking services for their merchants so deposits stay within their ecosystem.

Although Shopify Balance is not powered by SoFi today, there appears to be a good chance that there will be plenty of embedded banking services powered by SoFi in the future. A really good suiter for this would be Toast which already partners with Galileo for payment processing. Toast could build a similar platform as Shopify Balance but for their Restaurant partners. Which could potentially allow a merchant to open a business checking account, get a line of credit, accept payments and manage cash flow through the Toast platform powered by SoFi. Similarly, an Uber driver could get paid instantly, save money for taxes, get insurance and invest in retirement through the Uber platform powered by SoFi. And an Airbnb host could get a mortgage, rent out their property, earn rewards and donate to charity through the Airbnb platform powered by SoFi. You get the point.

It’s highly likely this is the path SoFi takes as they have already demonstrated the ability to get it done with Samsung. This was done before SoFi had all the pieces at their disposal, so it’ll be interesting to see what they are able to do / build moving forward.

How does it go wrong?

Like any other company SoFi is not without their risks. Certain things could definitely interfere with their ability to execute their vision, one as a bank, but two as the AWS of financial technologies. The most obvious risk would have to do with the macro environment we are currently in and we have seen that with the recent failures of SVB among others. A slowing economy hurts members' ability to spend which Galileo relies on for interchange revenues, and members ability to save which SoFi relies on to originate loans. We also know interest rates are entirely unpredictable at this point and any sudden drop in rates may lower the demand for SoFi’s Checking and Savings product, which is their main funnel for the productivity loop. SoFi also relies on various lines of credit, which if any of these other institutions were to go under (doesn’t seem like the Fed will let this happen though) SoFi would lose those alternative sources of funds. This is obviously entirely out of SoFi’s control.

As stated earlier, the financial services market is hyper competitive. If SoFi does not continue to innovate and offer differentiated products member growth could slow. In terms of the technology stack, they are still in the infancy stage of putting the pieces together, and although we have seen positive progress so far there is no guarantee the full stack is realized to it’s fullest potential in the market.

Am I buying, holding, or selling?

I wish I had money like Noto.

SoFi is trading at book value currently which seems insulting in my opinion. The potential is there and management has a good history of executing. I trust Noto and will continue to buy.

Disclaimer: The contents of this article reference my opinions and are for informational purposes only. This is not financial advice, and I am definitely not qualified to provide investment advice. Listen only if you can stomach owning way to much of this stock and watching it go down every day, and having to explain why to your wife, and ultimately having to write an article about it to justify your position to yourself.