TopGolf Callaway Brands Corp ($MODG) Overview

Before investing in any individual company, I aim to answer six questions.

What does the company do?

How did they get to where they are at today? (History)

What makes them unique? (Moat)

How is their unique proposition working out for them? (Financials)

What does the future hold for them? (Forecasting)

How does it go wrong? (Risk)

Here are my thoughts on Top Golf Callaway Brands Corp:

What is MODG?

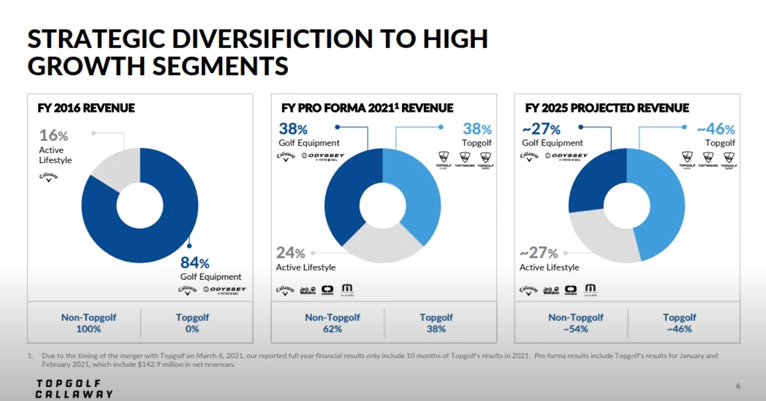

Topgolf Callaway Brands Corp is a company that is historically bad at picking tickers to represent their name. First with $ELY when they were Callaway Brands, to now $MODG after merging with Top Golf. Digging into it, $ELY was chosen because their founder’s name was Ely Callaway, and now MODG is supposed to represent “Modern Golf”. I mean just pick a ticker that makes sense, SoFi is $SOFI, Meta is $META, Topgolf Callaway Brands could have been $TGLF. Unfortunately, $GOLF was already taken, anyway it isn’t important. What is important is the idea of taking a boring but well known and respected golf and active lifestyle brands company, and merging an exciting technology driven golf entertainment business to it. That’s exactly what MODG is to me. Golf has always had an incredibly high barrier to entry, it’s an expensive sport that’s difficult to get good at (ask my brother) and playing a round of it takes half a day. This is where the idea of modern golf comes into play which uses technology to lower the barrier of entry and creates a natural pathway into the sport. Although the Top Golf and technology segment is the most exciting part of this business, Callaway also operates two other segments: Golf Equipment and Active Lifestyle. These segments design and manufacture high-quality golf clubs, balls, accessories and apparel under the well-known brands of Callaway, Odyssey, OGIO, TravisMathew, and Jack Wolfskin. For the sake of not having to type out Top Golf Callaway Brands Corp this entire article, I’ll refer to just Callaway as the parent company.

Here is a breakdown of their business segments:

How did they get to where they are today?

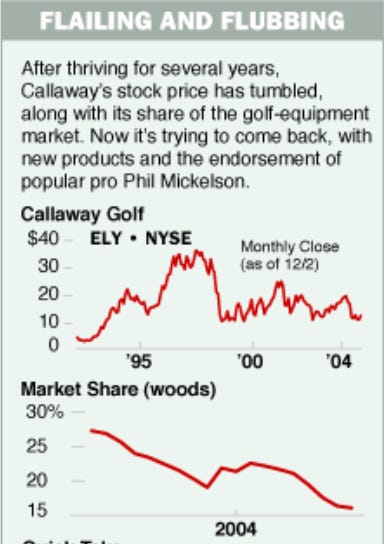

The history of Callaway dates back to way before I was born. They became a publicly traded company in 1992 and boomed to the success of their innovative products. Most notably the Big Bertha driver, which was the first of its kind to use an oversized metal head that golfers soon swore by. By 1993, Callaway became the revenue leader in Golf and by 1997 had a market cap of around 3 billion dollars. Today Callaway has a market cap of just over 3 billion dollars, so what has happened the last 15 years, and why would I be interested in a company that has been stagnant for so long?

I think it’s important to understand history in order to be able to assess if a company has pivoted away from its pitfalls of the past. It really boils down to not having a strong moat. Although Callaway dominated initially, all they did was create golf equipment, and soon cheaper alternatives started to steal market share. Other sports companies like Wilson and Spalding joined in and by 2004 Callaway’s market share was cut in half. In the early 2000’s Callaway entered the golf ball market but were beaten out on notable endorsements like Tiger Woods who used and won championships with Nike balls. The results just weren’t there anymore. I was able to find this snippet from a 2004 Barrons article which sort of paints the picture.

Once Callaway began to lose market share, they honestly appeared to have just hung around as a lackluster company for over a decade. In fact, I struggled to find anything notable between 2004 and 2012 to talk about. It wasn’t until after 2012 when current CEO Chip Brewer took over leadership of the company that things began to get interesting.

Market cap from inception to 2012:

Good thing for them is that there was something notable growing during that time period which was their soon to be acquisition, Top Golf. Started in the early 2000’s by Dave and Steve Jolliffe, Top Golf was a way to remove the time factor involved with golf and improve the game. By taking microchip technology and adding it to the golf balls, they created a new game that tracked and scored each shot automatically. The first Top Golf location opened in Watford, England, in 2000, and soon expanded to the United States in 2005 with investors focused on making it an experience. Location sizes grew to have event spaces, larger kitchens and bars. Callaway bit on this trend of off course golf entertainment early, buying a 14% ownership stake in 2006 which they would sit on for the next 14 years. In order to be in a position to acquire full ownership though Callaway would have to work on restoring itself to it’s former glory.

In 2012 Chip Brewer was chosen as CEO to do just that. With a renewed focus on R&D and stronger supply chain processes, Callaway began regaining market share and became profitable once again a few years later.

With these newly found profits, Callaway was able to reinvest and begin to build out their active lifestyle brands starting in 2017 with OGIO for $75 million, and later that year with Travis Mathew for $125 million. OGIO mainly designs bags and Travis Mathew mainly apparel. Then later in 2018 with the purchase of Jack Wolfskin for around 400 million, a maker of premium outdoor apparel and equipment. This allowed Callaway to expand their reach beyond just golf equipment and enter into a market that showed more promise of growth.

Then in early 2020 covid happened, and with governments forcing businesses to shutter in the name of public health, opportunities were presented to Callaway. Top Golf had been planning to IPO right around this time, expecting a valuation of around 4 billion dollars, but obviously things change when you can no longer do business. Callaway bet big during an incredibly difficult and unpredictable time and acquired Top Golf in an all-stock deal valuing them at 2 billion. When asked why, Chip stated “Topgolf is the best thing that happened to golf since Tiger Woods. It’s transforming the game. And it’s going to be the biggest source of growth for our industry.” I agree, and we will get into that further on in the article. Post merger, Topgolf immediately became the biggest piece of their business, generating more revenue than their golf equipment segment and their active lifestyle segment. Callaway further expanded their commitment to modern golf entertainment, buying a minority stake in Five Iron Golf, which is similar to Top Golf but instead is a smaller indoor golf simulator business.

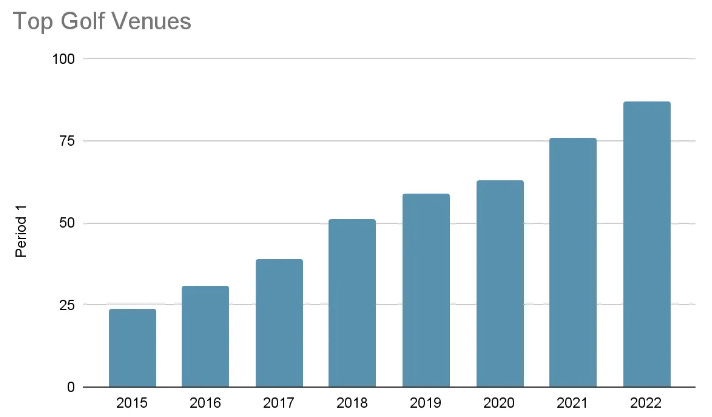

Since merging with Top Golf, Callaway has introduced 24 new venues, bringing the total number of venues to 87 globally.

That gets us to where we are today.

What makes MODG unique?

This is an incredibly important question considering Callaway’s lackluster performance had been due to their susceptibility to competition. That was before they had an unique funnel that reaches players of all skill levels of the game in Top Golf. There is no other golf company in the world with this advantage.

According to a survey done by the National Golf Foundation

“NGF research finds that off-course is not cannibalizing on-course, rather the traditional and modern forms of golf are complementing one another. A recent NGF study found that 75% of non-golfers who visited Topgolf said they’re interested in playing on a course. And 29% of golfers say playing at Topgolf leads them to play more traditional golf.”

Obviously, this is a great tool for expanding the reach of golf, and thus the customer base for Callaway’s other businesses. Breaking down the barrier to entry drives a huge influx of people who would otherwise never consider playing the sport, and Callaway gets first access to these customers right from the source. Each location is fitted with coaches and professional club fitters, which of course use Callaway clubs, and offer other opportunities to cross sell Callaway’s lifestyle brands.

Check out these charts of golf participation and you can see that off course golf is expanding with a younger diverse base, and participation is growing exponentially.

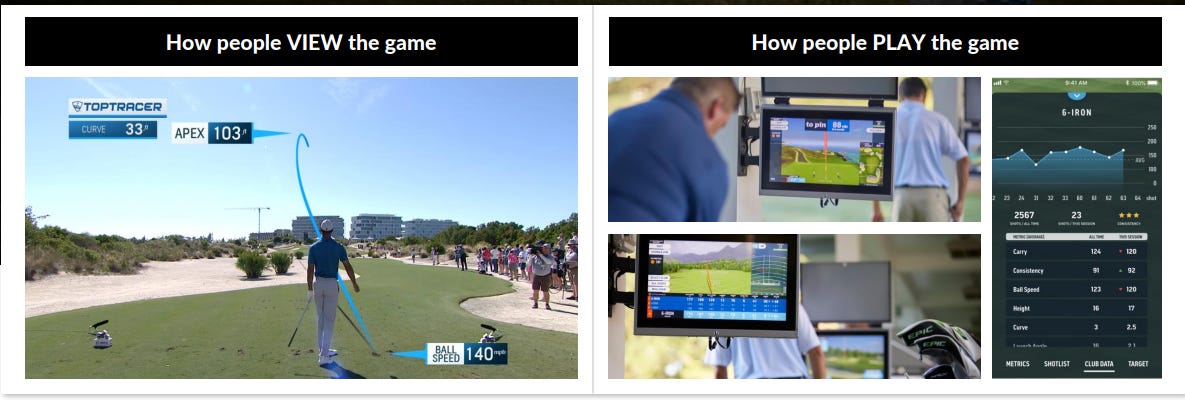

But Top Golf is also a technology company, primarily with their Top Tracer product, which means they have the ability to license that technology outside of their own venues. Top Tracer is used by TV networks, the most significant one being NBC, to show data on every tee and fairway shot during broadcasts. That same technology is licensed to driving ranges giving players access to the same data, which is invaluable for golfers.

This technology is in over 22000 driving range bays, which will continue to expand rapidly and for good reason. It makes the range experience much more enjoyable and useful from a customer perspective, increasing usage and again bringing more players to the game. On top of this Callaway has already recognized that these relationships with driving ranges creates a natural synergy between their other brands and has already opened the door to other opportunities.

The point is Callaway is deeply rooted in the golf experience today, way more than just the golf equipment it’s known for. No other golf company has this diverse of a portfolio, and reproducing the Top Golf advantage would be extremely difficult.

How is this working out for them?

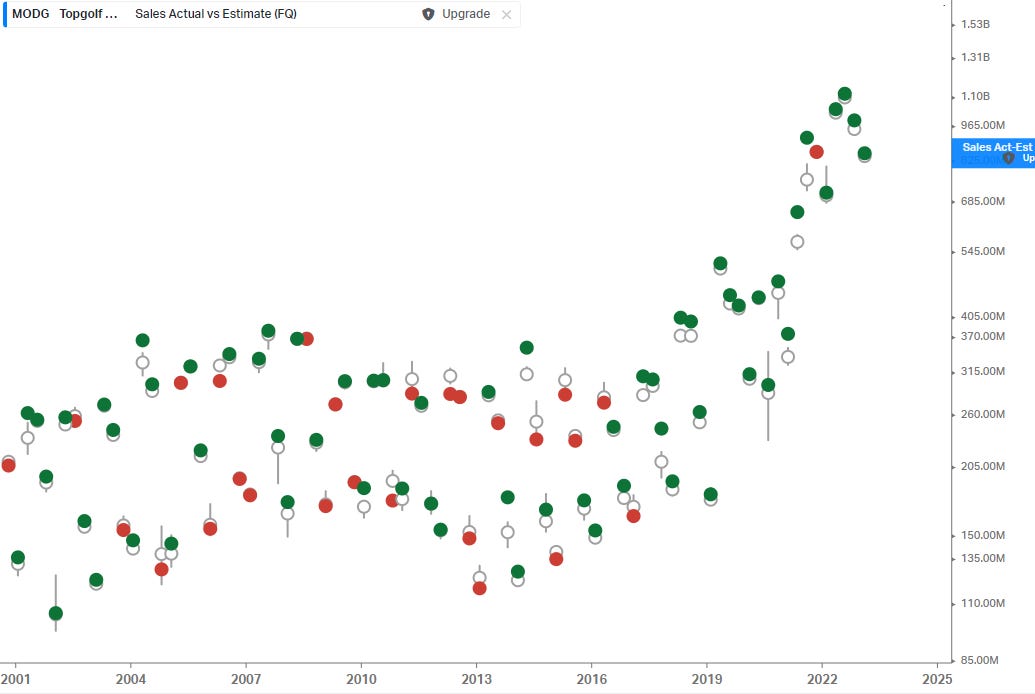

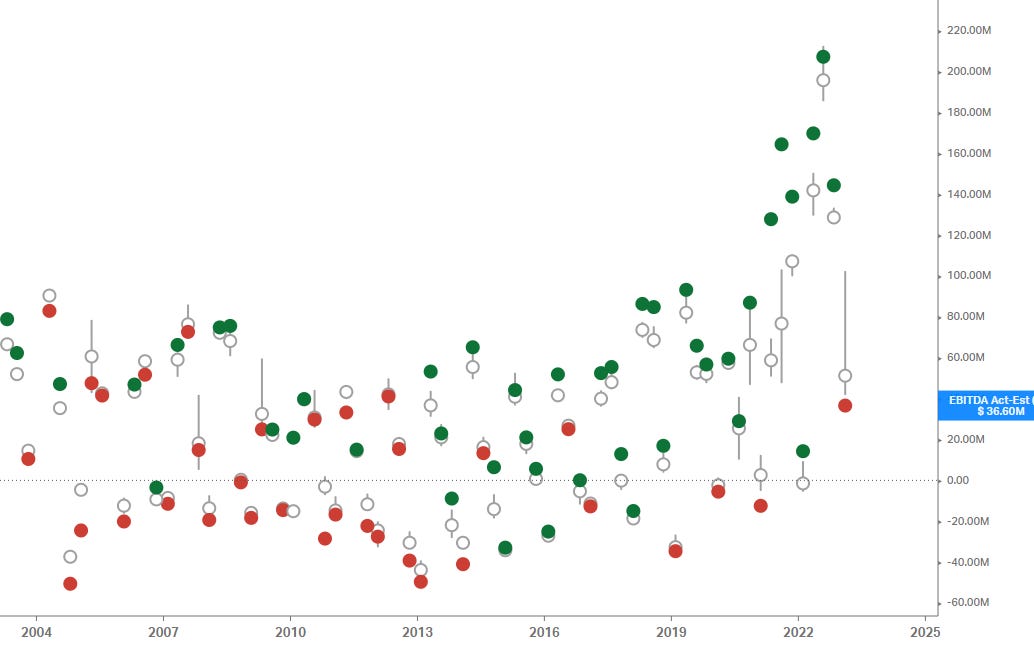

Big picture, revenues and EBIDTA are accelerating.

Sales vs Estimates:

EBITDA vs Estimates

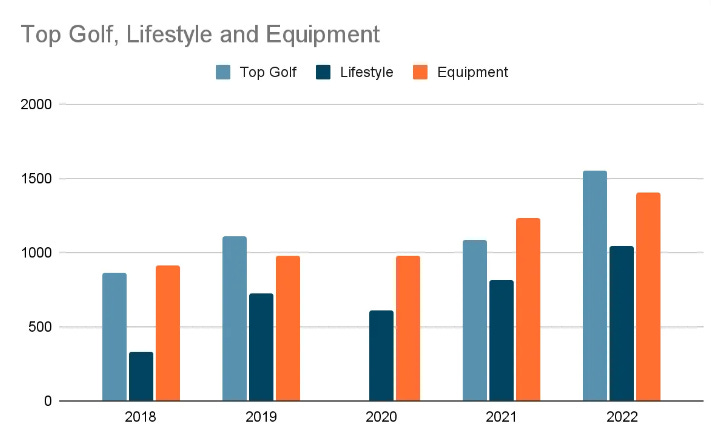

Full year 2022 revenue was just under $4 billion and full year adjusted EBITDA was $558 million, up 22% and 25% year-over-year, on a twelve-month or full calendar year basis. Keep in mind these numbers move up and down as Callaway operates better in peak seasons compared to others. Of that $4 billion dollars, $1.5 billion was solely added from Top Golf which provided half the full year EBITDA at $235 million.

Breaking this down you can see that Callaway is pretty well balanced between segments and is showing growth across all of them. Understandably things slowed in 2020 as the global economy was shut down.

On top of this, Callaway has shown a solid track record of building Top Golf venues at a rate of ~10 per year.

And they are able to do this in an incredibly efficient way with cash-on-cash returns of 40-50% by year 3. This basically means that the initial investment into building each venue is completely earned back by year 5. In addition to this growth, Top Tracer continues to be installed at a rate of ~7000 bays a year. These bays generate a licensing fee of ~$2000 per bay of high margin revenue for the Top Golf business.

Although anecdotal, I’ve found that having a positive experience with the company myself as a consumer helps bolster my confidence in the investment. This can also be seen in my article about SoFi, as I use them as my primary bank. You can read that here: SoFi Overview

I am part of the statistic of consumers who go to a top golf and become more involved with the game. As I became more involved with the game it led to additional purchases of golf equipment and apparel. The funnel works from my own personal experience, and it appears to be working from a fundamental perspective.

What does the future look like for them?

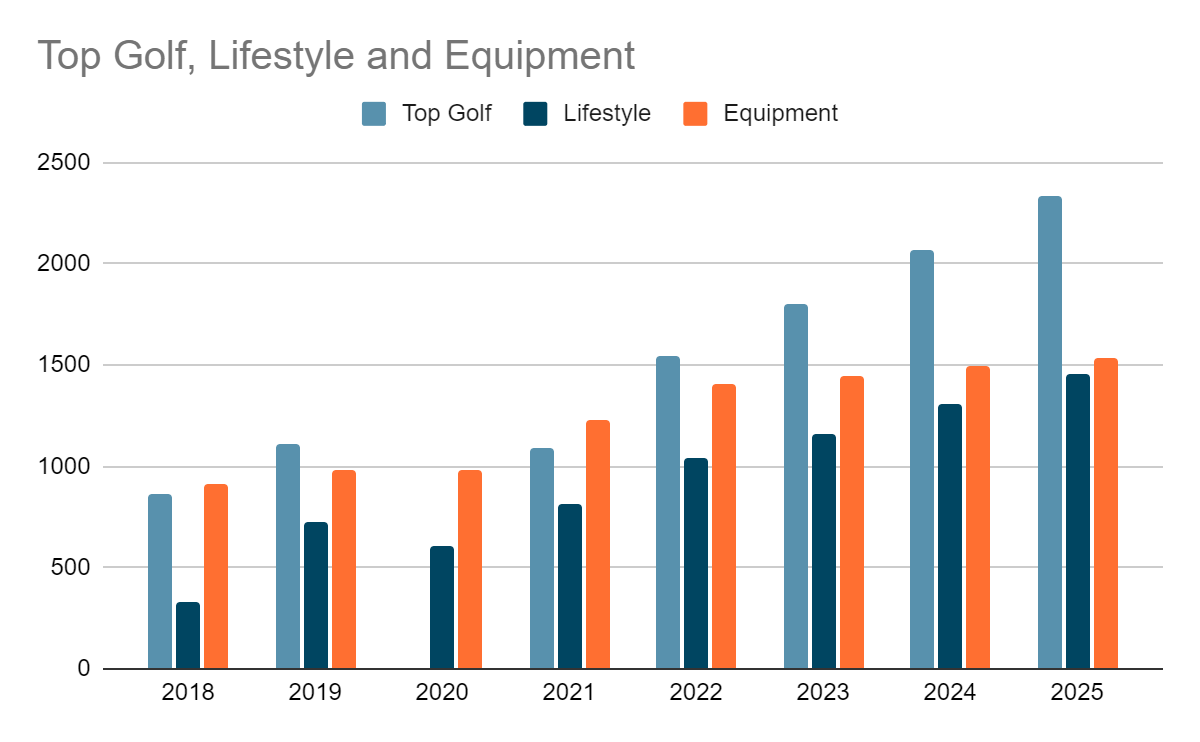

Callaway has every intention of leveraging their high cash flow golf equipment business to further grow the Top Golf brand. High level, this is what they are projecting up until the year 2025 for all of their business segments.

In terms of Top Golf, 11 new company owned venues a year would put them at 114 venues total. Likewise, ~8000 Top Tracer bays a year would put them at 45,000 total. Each Top Golf venue on average generates revenue of $17.5 million, and ~$2000 per Top Tracer bay. Assuming this remains consistent, and the projected growth of the other segments stays true here is what Revenues could look like:

These numbers assume the Golf Equipment business grows at a rate of 2% per year and the lifestyle brands at 12%. It also assumes same venue sales growth at Top Golf of 3% a year.

This represents a CAGR of ~15%.

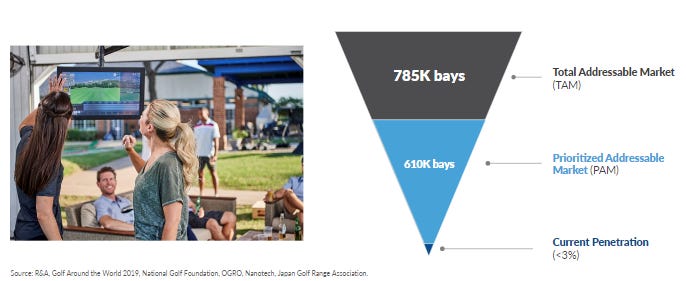

This expansion is backed up by Callaway who state that they have strong pipelines in place to make this possible. According to their 2021 investors day conference, they already have 450 globally identified areas for developing Top Golf venues. In terms of ranges, only 3% of the total addressable market has been penetrated.

Something also interesting to point out is the formation of Tiger Woods and Rory McIlroy’s new golf League, the TGL (which I think stands for “Tech-infused Golf League”, they haven’t made that part clear). Expecting to begin in 2024, the TGL will feature six teams of three PGA Tour players who will square off in match play on virtual courses. It’s basically going to attempt to squeeze 18 holes of golf into a 2-hour time period, in an arena that resembles a Five Iron Golf. I really have no idea how popular this will be, but I think it’s worth noting that the sport is transitioning to a new age fueled by technology, and it’s being embraced by the top pros of the game. Callaway is the leader in this space and is sure to benefit from it in my opinion.

How does this go wrong?

Like a majority of companies, Callaway operates in a highly competitive space that is subject to changing consumer preferences and economic conditions. Failing to innovate or create differentiated products, or missing out on high level sponsorships, may allow their competition to cut into their market share in the equipment and lifestyle brand segments. Significant macro environment shifts could also dramatically change their forward-looking guidance. Although Top Golf doesn’t have much competition in the golf space, they do have a ton of competition in the entertainment space, and if people have less discretionary income entertainment is usually the first thing to go. Callaway also relies on several variable rate lines of credit to help finance their expansion of the Top Golf business. Higher rates for an extended period of time will have adverse effects on profitability, but this could also potentially change the rate in which Top Golf is able to expand.

Am I buying, holding, or selling?

I think the concept of modern golf is appealing and is showing a lot of promise to expand golf’s reach and therefore Callaway’s customer base. I also believe that Callaway is a leader in this transition. Callaway is currently trading just at book value at a market cap of ~$4 billion dollars, the same price that Top Golf itself planned to IPO at, and the same price that Callaway was essentially valued at before merging with Top Golf. After peaking at around $38 a share back in June of 2021, shares have essentially been cut in half. I think that the core business itself is relatively safe due to its track record over the decades, and at current prices you’re getting all the potential in Top Golf at a significant discount. I’m cautiously optimistic, slowly adding to my position, with the main reason being that I myself enjoy Top Golf. I think that might be the best reason to own part of a company though, because you enjoy what they do.

Disclaimer: The contents of this article reference my opinions and are for informational purposes only. This is not financial advice, and I am definitely not qualified to provide investment advice.